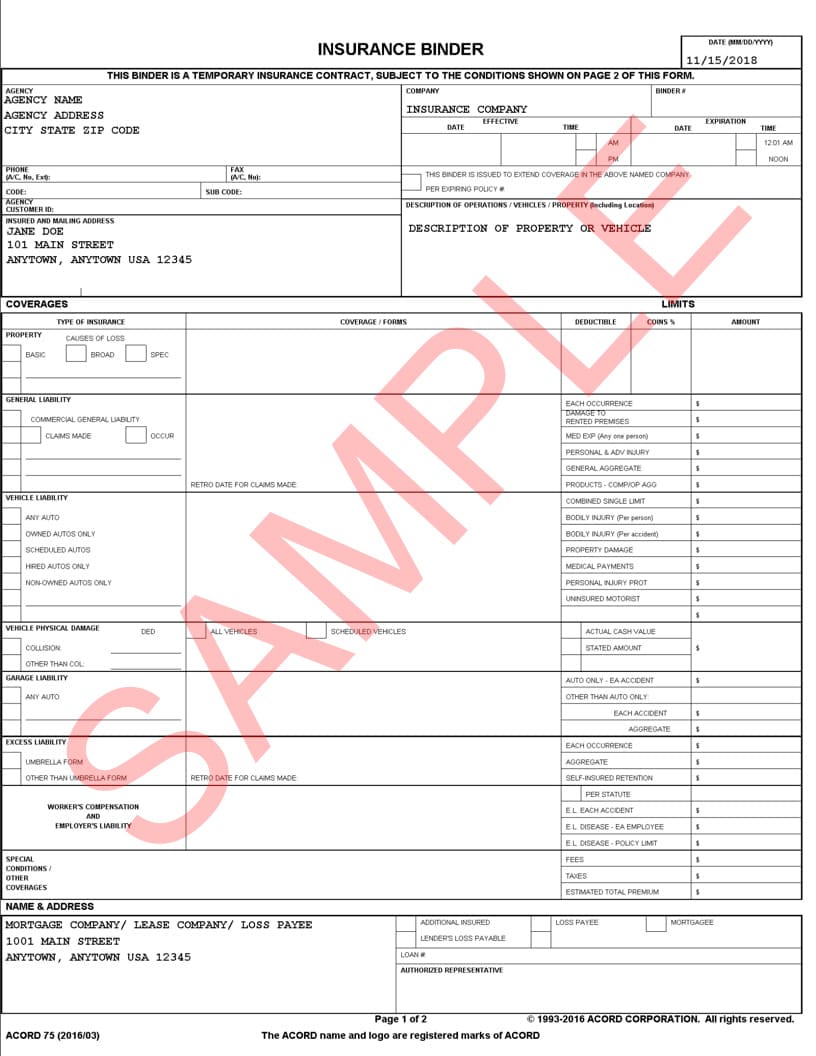

Protection Limits Of Your Plan Some of the most essential details shown on a binder will be the protection restrictions of your policy. To shut on a mortgage, your binder will certainly require to show the particular limits on your plan to see to it there is sufficient protection for your home.

The amount of cash you will pay out of pocket prior to the insurance provider starts to assist with insurance coverage. Each part of your policy will certainly have a various plan limit; your personal property limit will certainly be various from your individual liability limits (risks). This is where the insurance provider can notate any type of unique insurance coverages such as items added to the plan – cheaper auto insurance.

Montana's Minimum Responsibility Insurance policy Regulation for Motor Autos that fulfills the state's minimum coverage limits in 61-6-103, MCA: as a result of physical injury to or death of one person in any one accident and based on the limit for one person; due to physical injury to or fatality of two or more persons in any one https://storage.googleapis.com/why-my-car-insurance-company-raise-my-rates/index.html mishap; and because of injury to or destruction of home of others in any one crash.

cheap car cars cheapest cheapest car

cheap car cars cheapest cheapest car

vehicle insurance auto cheaper cars auto insurance

vehicle insurance auto cheaper cars auto insurance

The web service additionally offers troopers the ability to confirm the validity of a proof of insurance card based upon the action received from the providing insurance policy business. Troopers might additionally use MTIVS to digitally confirm that liability insurance policy was in result at the time of an accident – cheapest car insurance. Highway Patrol cannon fodders, like police officers from other law enforcement companies, have the discernment to make enforcement choices, such as whether to release a citation or caution, or neither, based upon details collected throughout a web traffic stop or crash examination.

The Auto-owners Insurance: Home Statements

The action received from MTIVS supersedes an insurance card produced by a car owner or operator, as well as regardless of the display screen of an insurance policy card by the owner or operator, the regulation enforcement officer might provide an issue as well as notification to appear to the owner or operator for an offense of state legislation.

Accidents including without insurance and also underinsured motorists cost drivers and also insurance policy business millions of dollars annually. Those who insure their automobiles legitimately basically pay the cost of the without insurance chauffeurs and the policies they ought to be lugging. In states with very high rates of uninsured vehicle drivers out on the roadways, guaranteed chauffeurs pay a huge premium for their compliance with the legislation (vehicle insurance).

vehicle insurance insurance auto vehicle

vehicle insurance insurance auto vehicle

Personal Injury Defense gives you with wage loss, fatality benefits and clinical insurance coverage regardless of fault. You may additionally acquire detailed and accident insurance coverages. cheap car.

cars cheaper cheaper cheapest car

cars cheaper cheaper cheapest car

Yes, the College Graduate Price Cut and also Defensive Driver Price cut for those insureds 55 as well as over that have actually successfully completed a course accepted by the Office of Chauffeur Providers. Consult your agent for any type of other discount rates your insurer may provide. A. Most likely since the insurance company enhanced its total rates due to the fact that it has paid more losses than expected.

The Basic Principles Of The Difference Between A Binder And A Certificate Of Insurance

This can vary by business. You must ask your agent if your policy covers you, those you might hurt if at fault, and also the rental agency's automobile. You are not needed to have homeowners protection by any Arkansas regulation.

Your borrowing establishment may have even more info on what degrees of insurance coverage it requires you to maintain. A. There are a number of different types, but many homeowners carry full coverage for all risks including losses related to any unexpected and also unexpected event. In the instance your residence is entirely damaged, you might want to take into consideration having substitute price coverage to make sure that you can rebuild your home.

Various other kinds of home owners insurance coverage cover just fire and climate events. An insurance policy business might use credit rating AS PART of the process of identifying whether protection will certainly be given and also what it sets you back.

A rating established by the tools, manpower, water source as well as various other aspects of a fire area. Classifications range from 1 to 10, with 10 being an extremely rural location with really little fire defense., or ISO, examines neighborhood fire divisions as well as sets the category.

What Is A Home Insurance Binder? (2021) – Insurify Can Be Fun For Anyone

We have wide authority to assess just how the price is dispersed among insureds according to factors that may predict future losses, but A price ends up being excessive when the loss ratio (losses separated by premiums paid) goes down to a factor which results in the insurer making a too much amount of earnings. insurance companies.

It is a health problem you had before you purchased your health insurance policy protection, such as cancer cells, no matter of whether you received a medical diagnosis or therapy prior to the acquisition. There are numerous situations in which your health and wellness provider can decline to cover your pre-existing problems.

To show, intend a person had protection for 2 years followed by a break in coverage of 70 days as well as then resumed insurance coverage for 8 months. That individual would only receive credit report for 8 months of coverage; no credit score would be offered for the 2 years of coverage prior to the break in protection of 70 days.

We can inspect to see to it that both the insurance provider as well as manufacturer offering it are properly accredited (insured car). Right here are some other risk signs: Be careful if a licensed insurance policy agent tries to offer you health protection that claims to be an ERISA plan. Be doubtful if the plan provides insurance coverage without pre-existing condition exclusions.

Goosehead Insurance: Compare Insurance Quotes Today Fundamentals Explained

Health and wellness insurance coverage firms, including HMOs, have 1 month to pay a claim to either you or your medical supplier, if the case is digitally filed with the wellness insurance policy business (automobile). If the case is sent by mail to the medical insurance firm, the health insurance policy firm has forty-five days to pay the insurance claim.

If the case is nonetheless not "clean" or the wellness insurer requires even more details to process the case, the health and wellness insurance company is permitted 30 days to gather the details, and after all of the called for details is obtained by the health and wellness insurance firm, the 30 (digital) as well as 45 (non-electronic) day repayment regulations after that apply.

No, it is not mandated by the Arkansas Insurance Division. Problem of Maternity is a protected advantage. insurance companies. In company teams of more than 15 staff members, Title VII of the Civil Legal Right Act of 1964 states that any health and wellness insurance provided must cover expenses for pregnancy-related conditions on the exact same basis as expenses for other clinical conditions.

A. affordable car insurance. Yes, state continuation is for 120 days as described under ACA 23-86-114. A. Yes. The Division, nonetheless, calls for that the medical provider give proof in the issue revealing a "pattern of sluggish settlement" practices by the health insurer or HMO. A. Yes. An insurance company needs to consider the relevant stipulations of the Arkansas Trade Practices Act, Ark.

The Best Strategy To Use For What Is A Declarations Page? – Njm

cheap auto insurance cheapest cars auto insurance

cheap auto insurance cheapest cars auto insurance

A. You can call your health and wellness carrier or the Arkansas Insurance Department. A. Your health and wellness carrier will provide you this details in your policy and after your insurance claim is denied (liability). A. Within 45 schedule days of the IRO's receipt of the ask for the external review. For an accelerated testimonial, the review is finished as quickly as necessary, yet no later than 72 hrs after the IRO obtains the ask for expedited testimonial.

People or companies might secure insurance protection directly from a non-admitted insurance provider. Your agent can assist you if surplus lines insurance coverage is needed. If your business considers you to be a vital policeman or supervisor or supervisor,